- Business & Data Research

- Posts

- Credit Risk Rating using R Program

Credit Risk Rating using R Program

Risk Rating Analysis - Financial Data

Credit Risk Rating Performance Descriptive Statistics:

Credit risk rating analysis is the process of evaluating a borrower’s ability to repay debt and assigning a risk grade or score that reflects the likelihood of default. It helps lenders, investors, and institutions make informed decisions about extending credit.

Step 1: Required Packages

library(dplyr)

library(tidyverse)

library(ggplot2)

install.packages("ggthemes")

library(ggthemes)

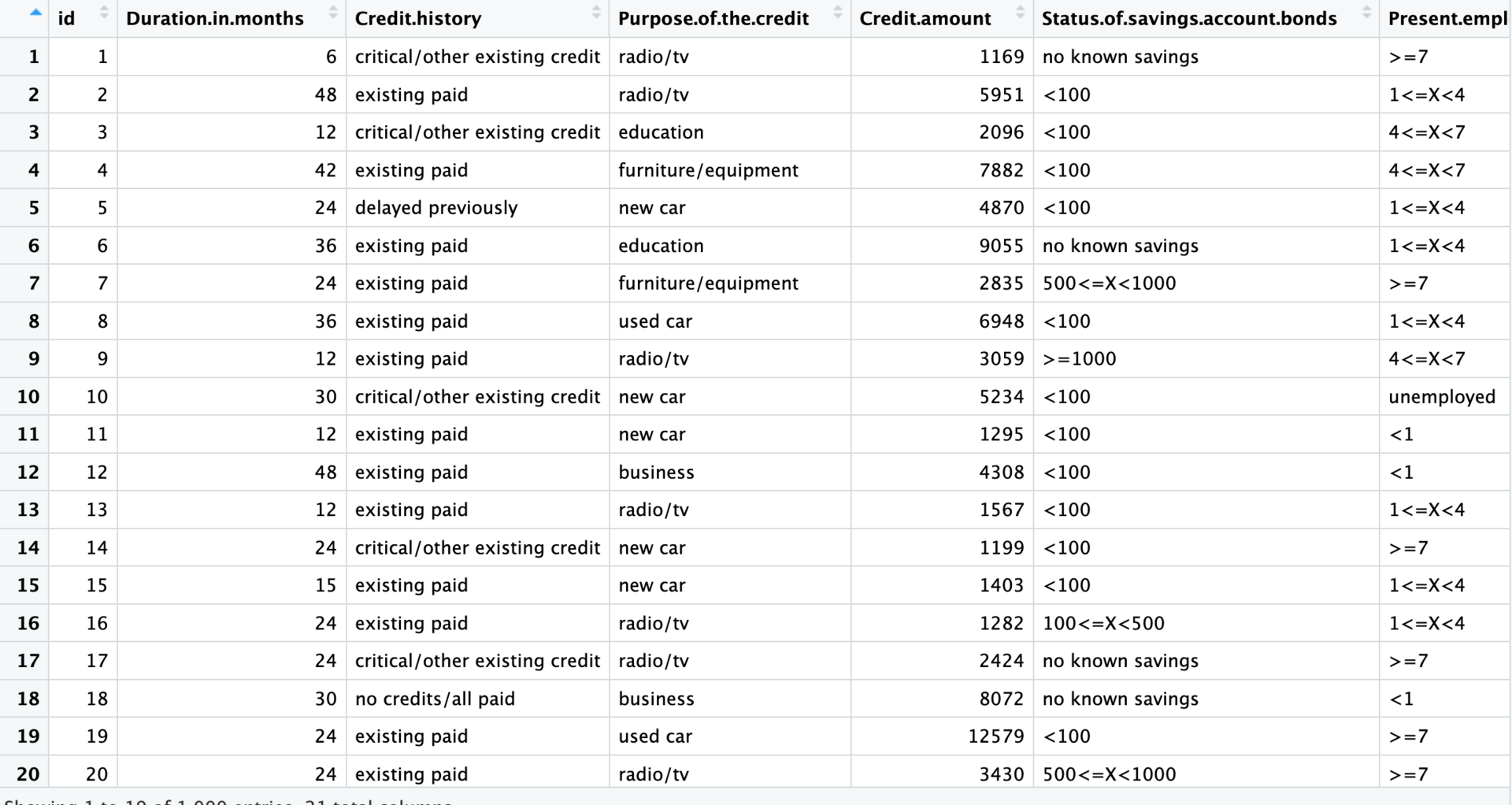

Step 2: Load the Dataset

loan <- read.csv('/Users/Sample Datasets Kaggle/dataset.csv', header = TRUE)

View(loan)

str(loan)

Step 3: Install additional libraries gmodels and ensure gtools is properly installed in your local environment

library(gtools)

install.packages("gmodels")

library(gmodels)

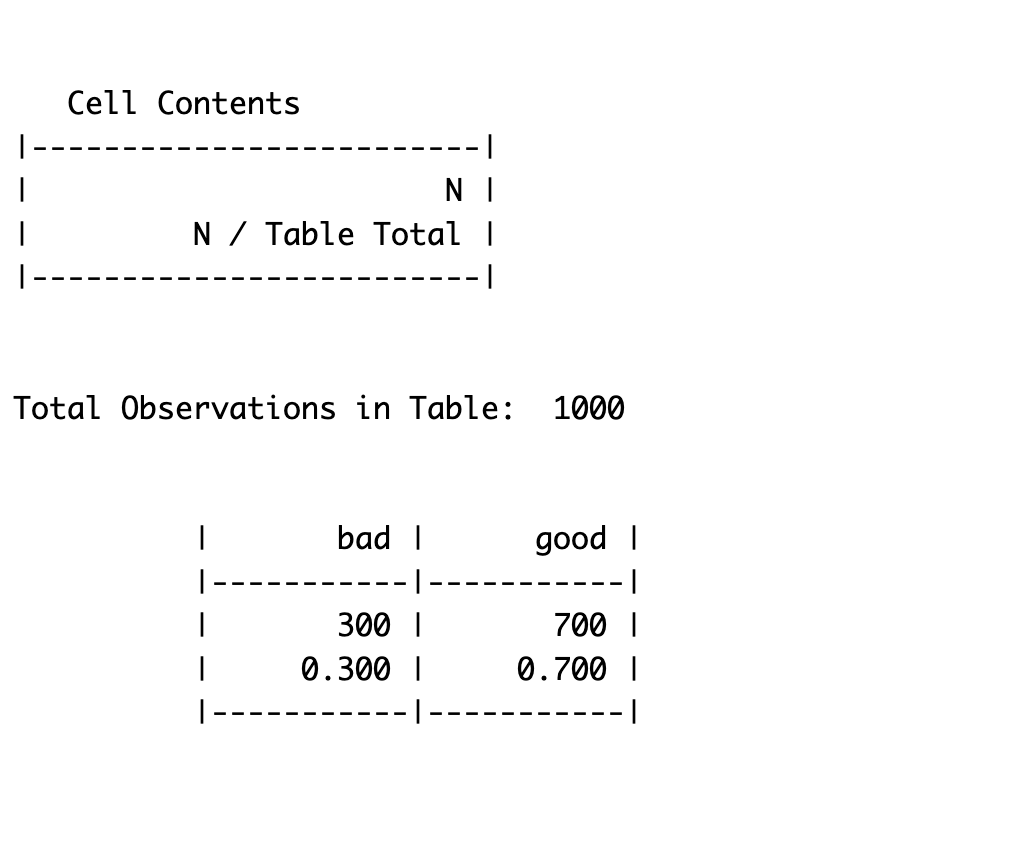

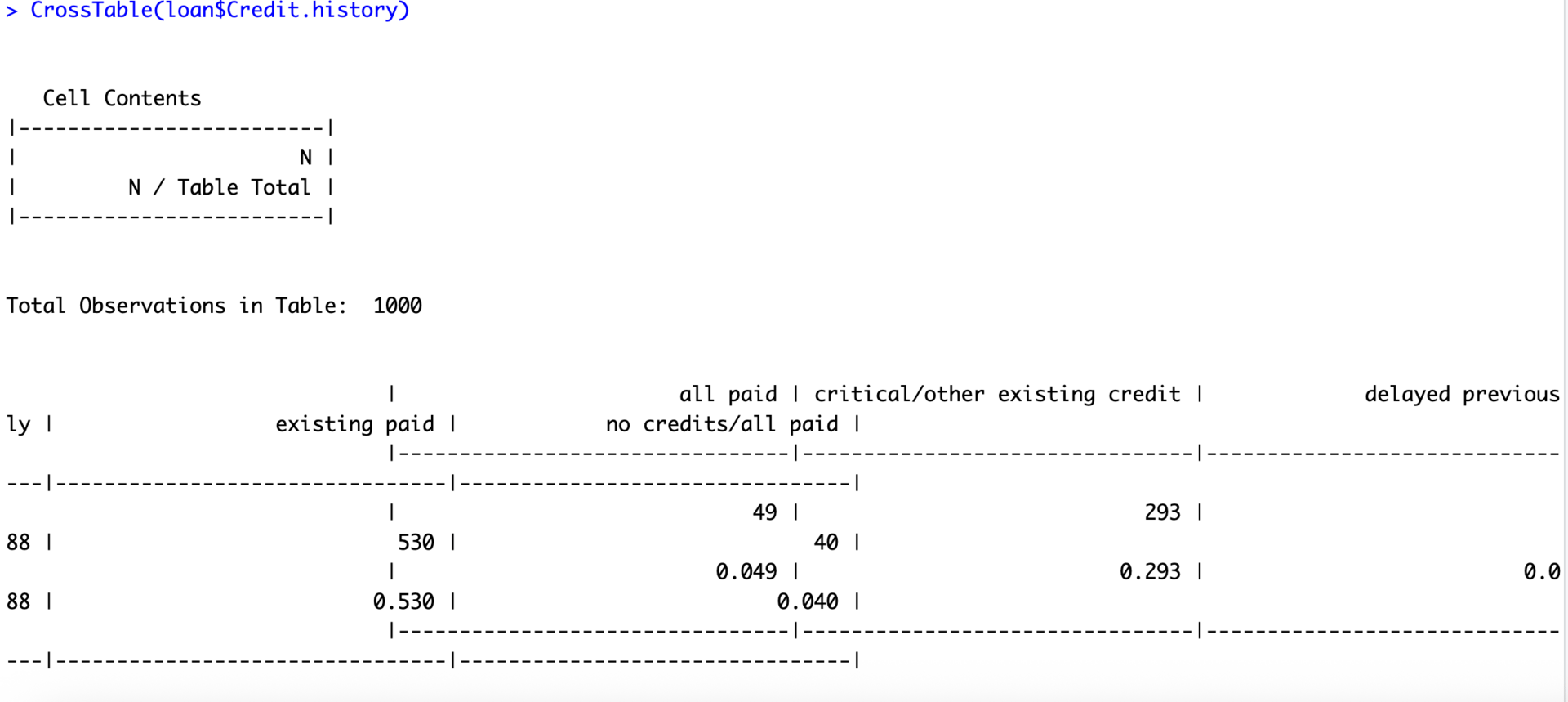

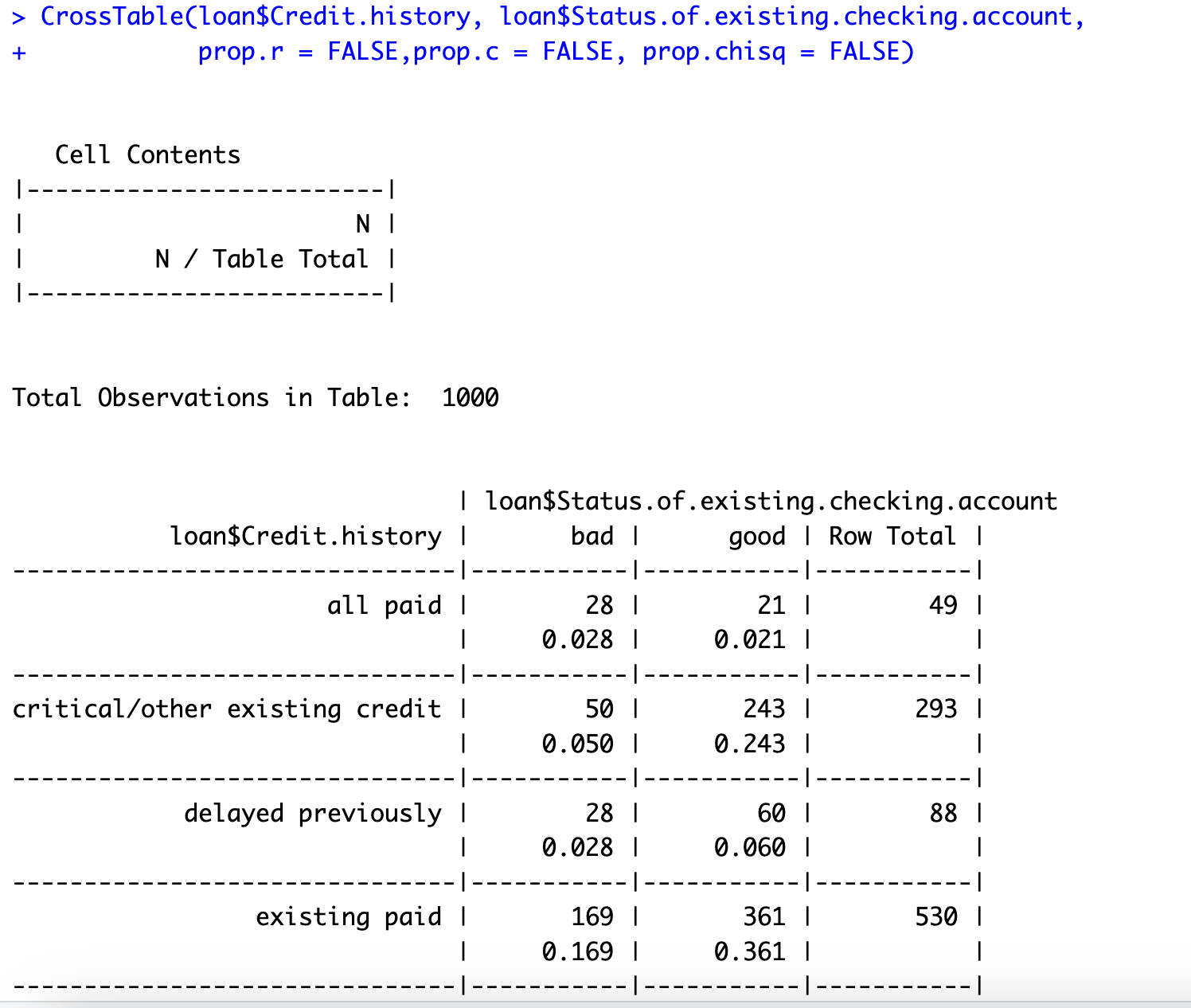

Step 4: Using CrossTable, check the loan status of the existing checking account

Step 5: Describing the loan status of the customers

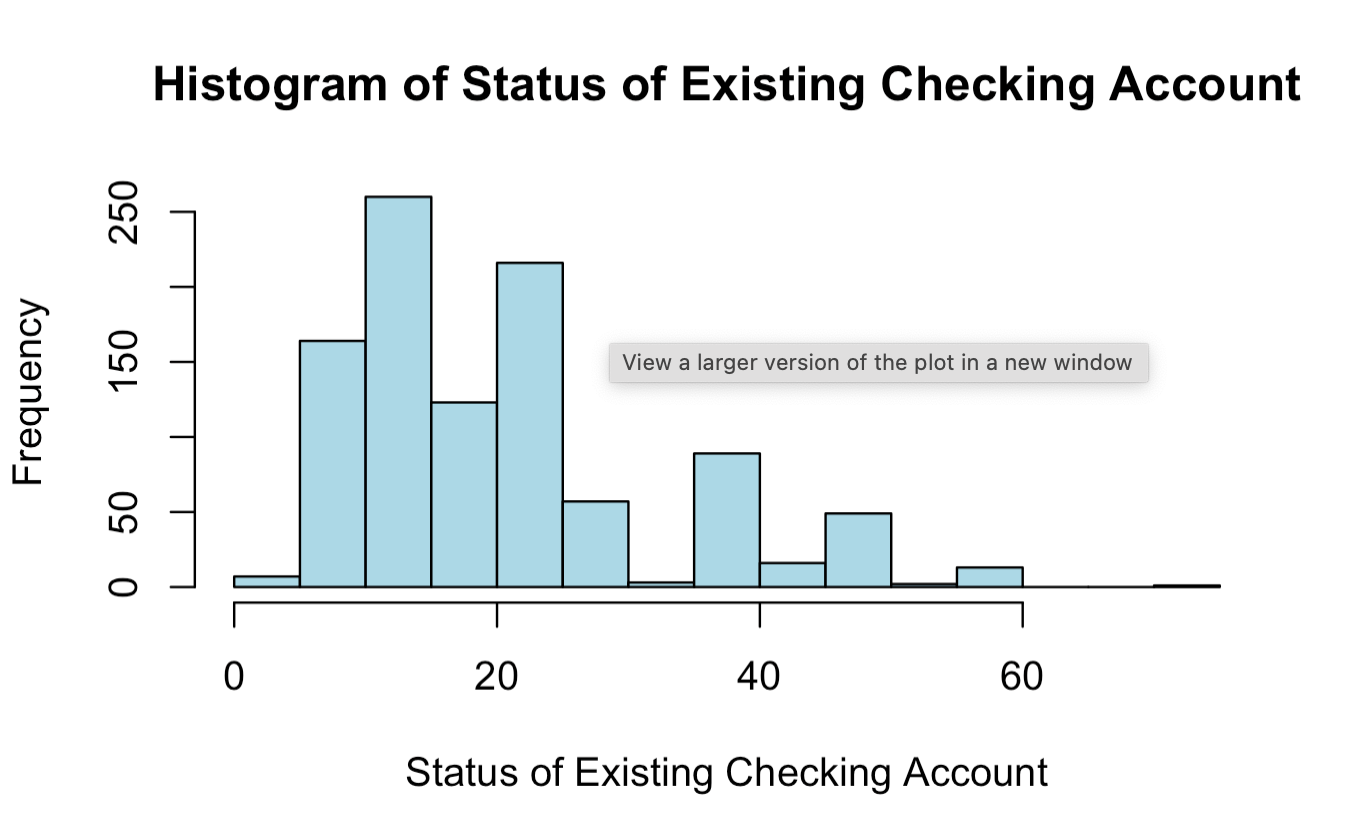

hist_loan_status <- hist(loan$Duration.in.months,

main = "Histogram of Status of Existing Checking Account",

xlab = "Status of Existing Checking Account",

ylab = "Frequency",

col = "lightblue",

border = "black"

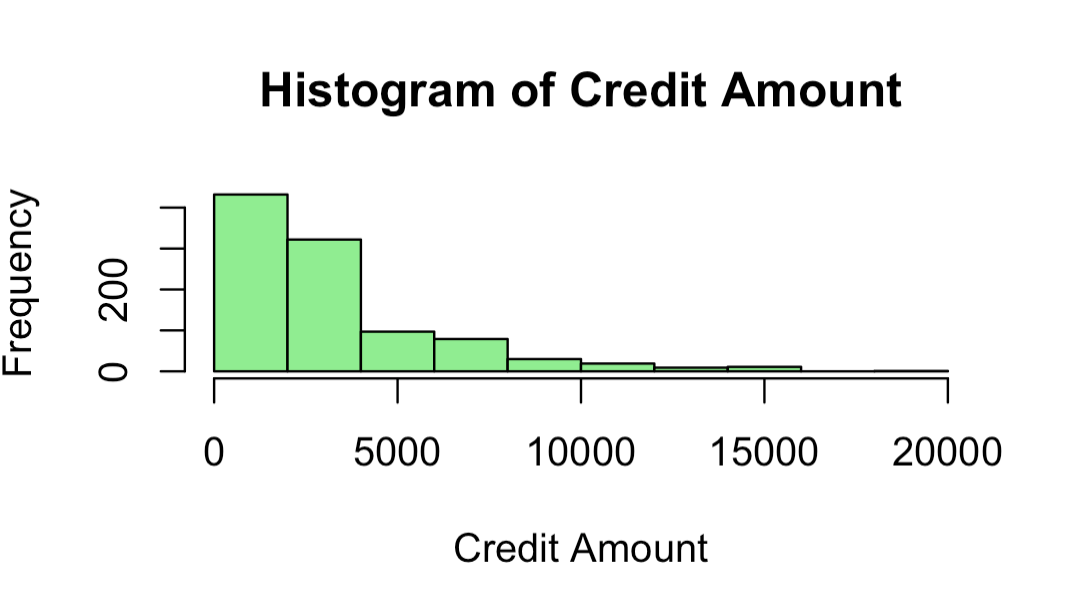

hist_loan_2 <- hist(loan$Credit.amount,

main = "Histogram of Credit Amount",

xlab = "Credit Amount",

ylab = "Frequency",

col = "lightgreen",

border = "black")

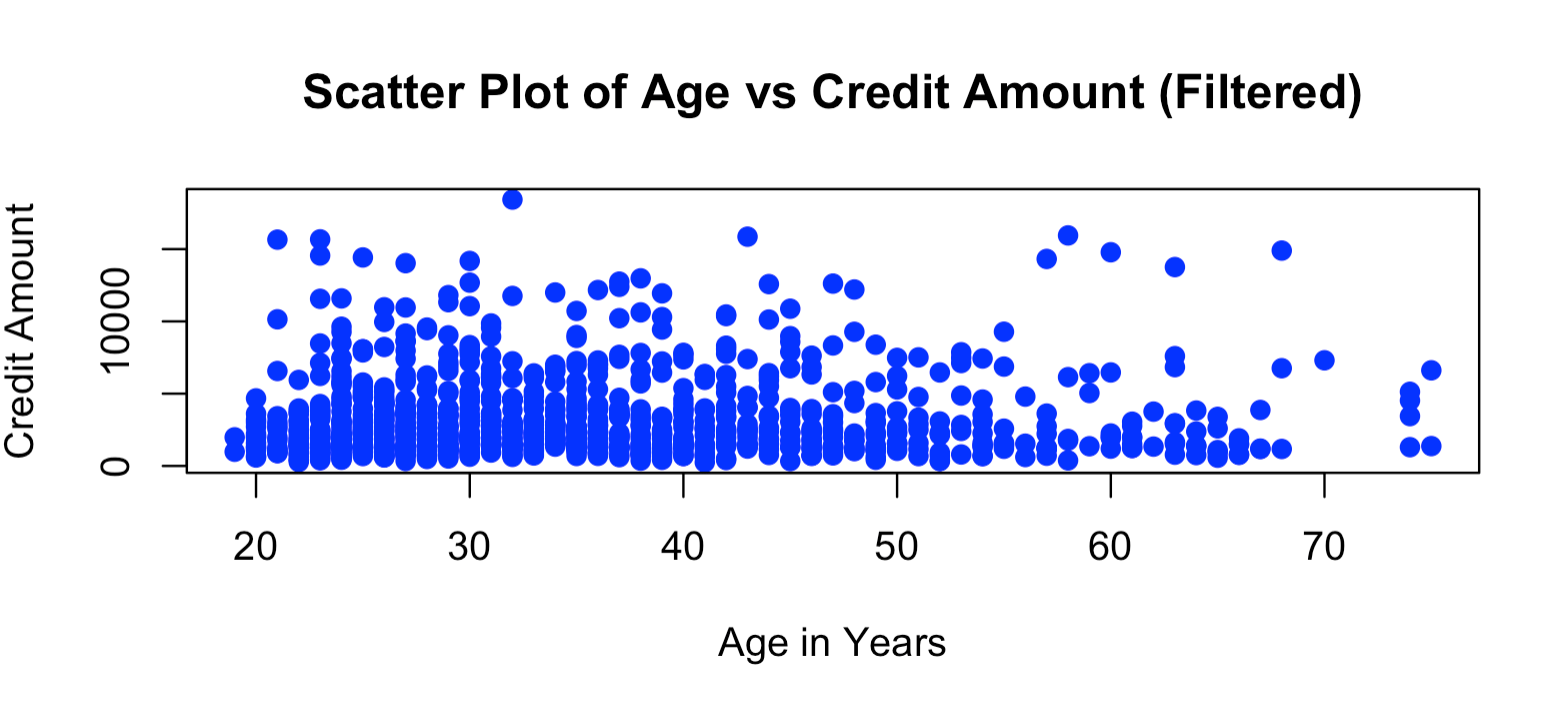

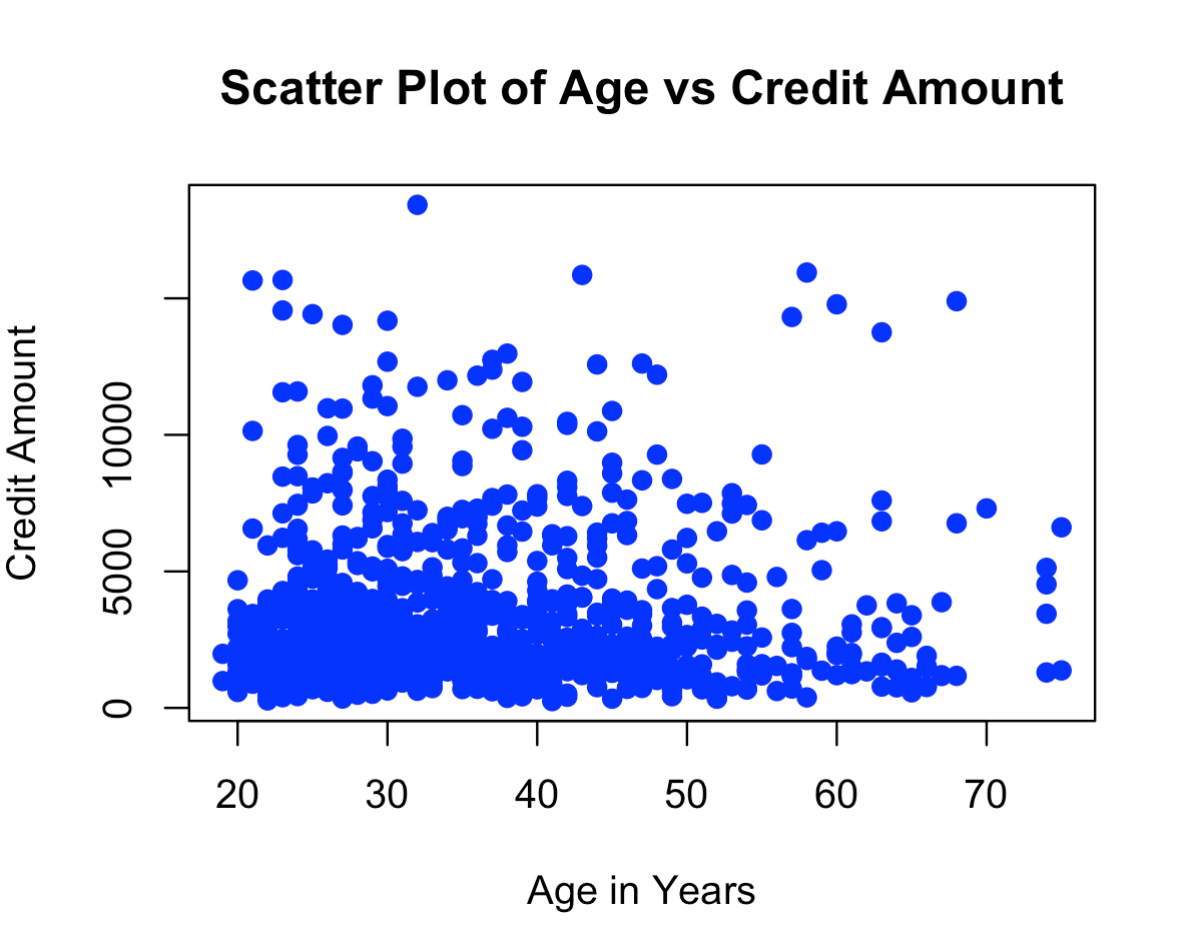

Step 6: Creation of a scatter plot based on Age vs amount credited

Step 6.1: Identify the outlier just to check how much the amount is credited based on the age

# Identify the index of rows where Age is greater than 60

index_high_age <- which(loan$Age.in.years > 60)

# Print the rows with Age greater than 60

index_high_age

newdata <- loan[-index_high_age, ]